Los Angeles Car Sales Tax Calculator

26 Zeilen Select View Sales Rates and Taxes then select city and add percentages for total sales. How 2021 Sales taxes are calculated in Los Angeles The Los Angeles California general sales tax rate is 6.

H R Block Tax Calculator Services

As one to the most expensive states to purchase a new vehicle as far as taxes go it will make you just a bit afraid of all the beautiful cars that youre looking at.

Los angeles car sales tax calculator. 21450 for a 20000 purchase. To calculate the amount of sales tax to charge in Los Angeles use this simple formula. 65 is the smallest possible tax rate Los Angeles California 725 7375 75 775 7875 7975 8 8125 825 8375 8475 85 8725 875 8875 8975 9 9125 9225 925 95 975 10 1025 are all the other possible sales tax rates of California cities.

For Vessels the CF must be left out as part of the number. For Kids Plates please leave out any symbols. Do you know your vehicles license plate number.

California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Los Angeles CA. Of this 125 percent goes to the applicable county government.

California City County Sales Use Tax Rates effective July 1 2021 These rates may be outdated. The December 2020 total local sales tax rate was also 9500. California Used Car Sales Tax Fees.

Look up the current sales and use tax rate by address. The sales tax is higher in many areas due to district taxes. Calculate My Fees Fee Calculator Required New Vehicle Fees Vehicle Information Type of Vehicle More about vehicles types.

Los Angeles CA Sales Tax Rate Los Angeles CA Sales Tax Rate The current total local sales tax rate in Los Angeles CA is 9500. Some areas have more than one district tax pushing sales taxes up even more. California statewide sales tax on new used vehicles is 725.

Model Year YYYY Type of Trailer Permanent Trailer Id PTI Park Trailer Trailer Coach Motive Power Gas. This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city and county tax officials. Enter the last 5 digits of the vehicle identification number.

Depending on the county and city you live in there will be. 725 sales tax in Ventura County. You can use our California sales tax calculator to determine the applicable sales tax for any location in California by entering the zip code in which the purchase takes place.

Using the California car sales tax calculator can help you figure out exactly how much a new vehicle will cost so there wont be any surprises when. Depending on the zipcode the sales tax rate of Los Angeles may vary from 65 to 1025. Local governments such as districts and cities can collect additional taxes on the sale of vehicles up to 25 in addition to the state tax.

The California state sales tax rate is 725. Well try to help you know what you are looking at as far as spending after the sale price of the car. California sales tax details.

Airport Los Angeles CA is 9500. Airport Los Angeles CA Sales Tax Rate The current total local sales tax rate in LA. Calculating your California car tax could be a tricky proposition.

Depending on local sales tax jurisdictions the total tax rate can be as high as 1025. 105 is the highest possible tax rate Santa Fe Springs California The average combined rate of. You may also be interested in printing a California sales tax table for easy.

1075 sales tax in Alameda County. Do not use blank spaces. Districts cities and other local.

Leave out special characters when entering a plate number. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to California local counties cities and special taxation districts. Sales tax total amount of sale x sales tax rate in this case 95.

When youre purchasing a new or used car its important to understand the taxes and fees you may face. According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

How To Use A California Car Sales Tax Calculator

/cdn.vox-cdn.com/uploads/chorus_asset/file/19755440/Hollywood_For_Sale.jpg)

Fact Check Graduated Income Tax Advocate S Claim About California Needs More Context Chicago Sun Times

Income Tax Changes In The Covid 19 Era Los Angeles Times

Pin On Buying Or Leasing A Vehicle

Understanding California S Sales Tax

California Sales Tax Calculator

Calculate The Sales Taxes In The Usa For 2021 Credit Finance

How To Calculate Cannabis Taxes At Your Dispensary

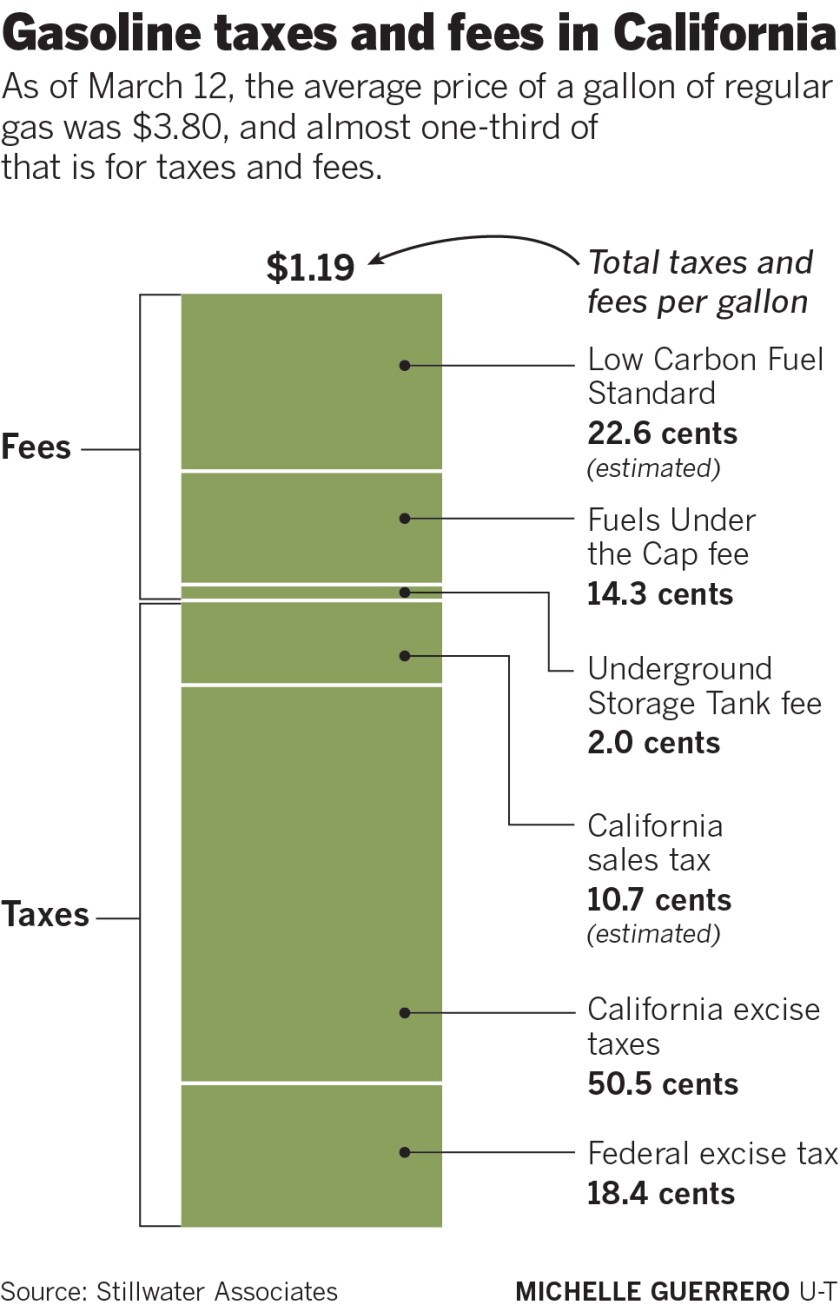

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

H R Block Tax Calculator Services

Understanding California S Sales Tax

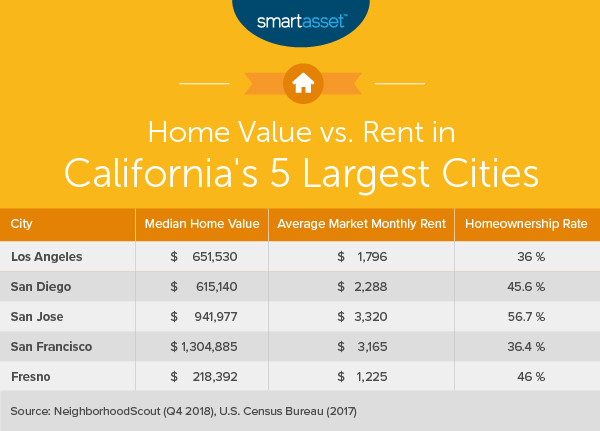

The Cost Of Living In California Smartasset

How To Calculate Cannabis Taxes At Your Dispensary

Understanding California S Property Taxes

California Used Car Sales Tax Fees 2020 Everquote

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

How Much Is Used Car Tax In Nevada Reliable Auto Sales Las Vegas

Post a Comment for "Los Angeles Car Sales Tax Calculator"